See This Report about Condominium Associations Insurance

What Does What is Condo (HO6) Insurance? What Does it Cover? Do?

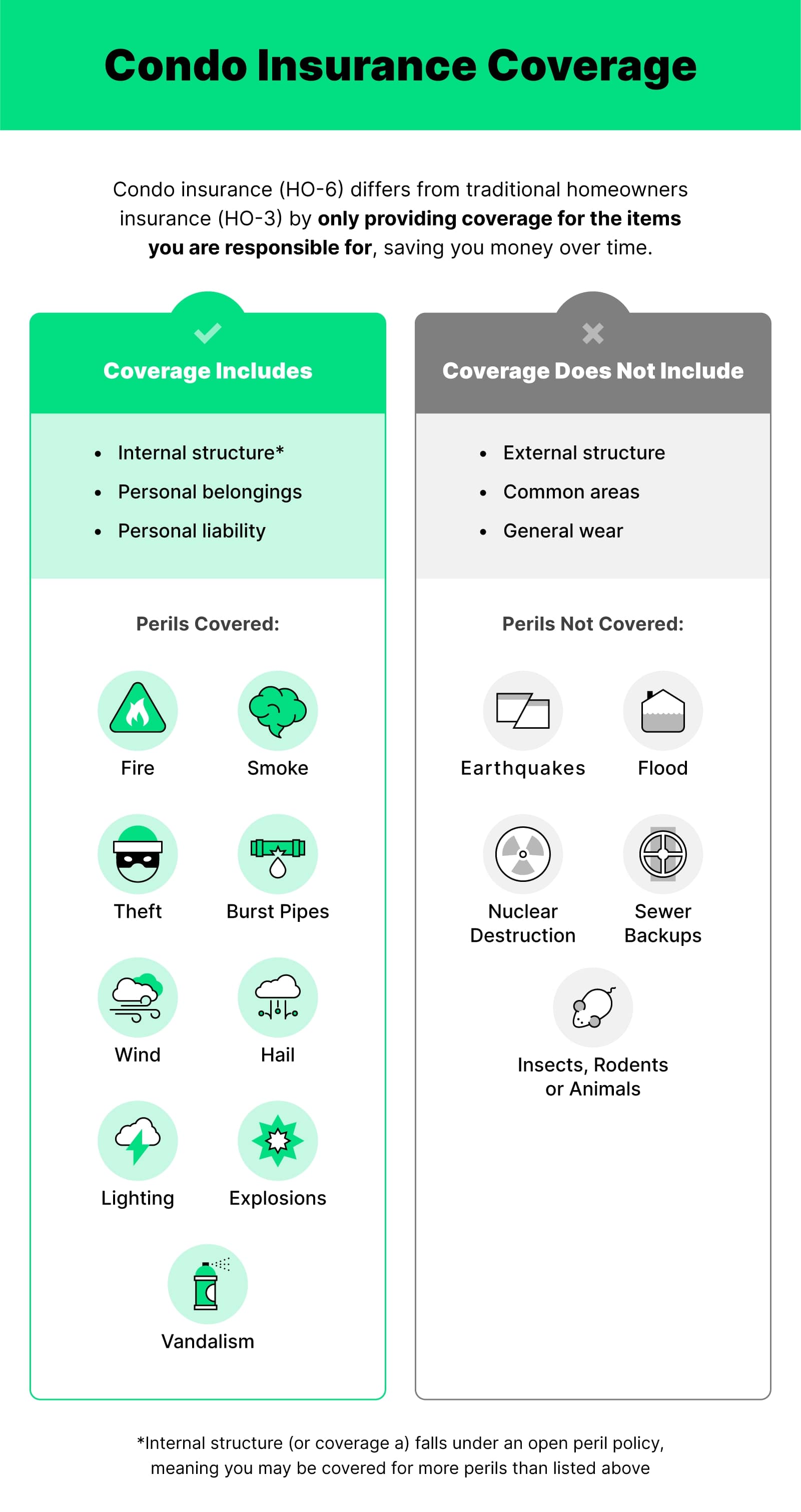

Condominium insurance is an insurance coverage purchased by the condominium owner that helps cover costs associated with property damage to the unit or loss of individual possessions. Consider it as property owners insurance coverage for a condo. However, ensure you also understand what is covered under your property owner's association (HOA) policy, sometimes referred to as a Master Condominium Policy, before choosing on your protection.

Condominium Owners Purchasing Insurance Beware! Buy The Right HO6 Policy From a Qualified Agent - Condominium Insurance Law

Securing your residential or commercial property Include a layer of protection for your individual property in the event of fire, theft and other circumstances of destruction. Protecting you from liability claims PEMCO can help give you comfort and defense if you're found lawfully liable for injury or damage at your condominium.

Meaning Property owners' insurance is a specific kind of home insurance coverage. Homeowners' insurance covers damage or loss by theft and versus dangers which can consist of fire, and storm damage. It likewise may guarantee the owner for accidental injury or death for which the owner may be legally accountable. Home loan lending institutions normally need homeowners' insurance coverage as part of the mortgage terms.

Some Known Factual Statements About Understanding Condo and Co-op Insurance Coverage - The

Homeowners' Insurance Policies There are multiple kinds of property owners' insurance coverage. HO-1 Fundamental Form HO-1 policies are one of the most basic kind of homeowners' insurance. HO- This Is Noteworthy is a called danger plan, so anything that happens beyond the hazards particularly named in the policy is not covered. The standard kind of property owners' insurance just covers 10 dangers: fire or smoke, explosions, lightning, hail and windstorms, theft, vandalism, damage from lorries, damage from aircraft, riots and civil commotion, and volcanic eruption.

NEA Condominium Insurance - NEA Member Benefits

HO-2 Broad Form HO-2 policies are a broad type of home insurance coverage. Similar to HO-1 policies, this kind of house insurance coverage just covers hazards called in the policy. Aside from covering the home's structure, HO-2 usually covers personal possessions, and some policies provide protection for personal liability. The broad type of property owners' insurance coverage covers all of the perils named in HO-1.

Condominium Insurance in Emerald Isle, Beaufort, New Bern, & Havelock

HO-3 Special Type HO-3 policies are an unique type of house insurance coverage. HO-3 is an open-peril policy, rather than a named-peril policy like HO-1 and HO-2. That indicates unless the insurer leaves out a hazard from the policy, then the policy covers any kind of peril, called or not. Usually, an HO-3 policy will cover the house's structure, along with any structures that are attached, like a carport or garage.